As we close out 2025, I want to reflect on what drove results across the portfolio, where we were right, where we were wrong, and how our process continues to evolve. This year reinforced a familiar truth in investing. Outcomes are rarely driven by a single macro call or one elegant narrative. They are driven by disciplined position sizing, a repeatable research process, and the willingness to change our minds when facts change.

2025 also marked a meaningful shift in how we operate day to day. Our research workflow is changing in real time as new tools become available. The impact is practical, not theoretical. It shows up in the number of ideas we can track, the speed with which we can test hypotheses, and the breadth of industries we can monitor without lowering our standards.

Markets & AI

2025 marked another strong year for major indices, with total returns of 21.1% for the Nasdaq, 17.9% for the S&P 500, and 14.9% for the Dow. These headline figures mask a much more fragmented market beneath the surface. The bulk of returns was driven by a narrow group of megacap names, continuing the trend of index concentration and raising important questions about breadth and sustainability.

Beneath that surface, however, was broad underperformance across many segments of the market. Numerous companies, including structurally sound businesses, remain 50–70% off prior highs. Much of this dislocation stems from uncertainty around the long-term effects of artificial intelligence on business models, particularly those reliant on seat-based enterprise pricing. There remains a critical open question: will AI augment user productivity such that adoption increases and drives incremental value per seat, or will it enable significant headcount reductions, thereby shrinking overall demand footprints for software and services?

We view 2025 as the year of exploration of testing tools, evaluating workflows, and beginning the long, iterative process of integrating AI into enterprise environments. 2026 is shaping up to be the year of implementation and rationalization. Across industries, companies are now positioned to make more permanent decisions around staffing, automation, and digital infrastructure. The productivity potential of AI is undeniable. Tasks characterized by low variance, repeatable input-output relationships, like data extraction, reporting, and standardized communication, are particularly vulnerable to displacement. We are likely to see meaningful restructuring initiatives that realign operating models around these new capabilities.

What is essential for investors to understand is that while this transformation will unlock efficiency, it is not uniformly positive for all firms. Many businesses have yet to fully articulate how their unit economics evolve under different adoption curves. Those with pricing models decoupled from seat count or those able to align pricing with productivity gains may fare better. Conversely, companies whose business models rely on user density, manual workflows, or opaque service layering may experience acute pressure.

From a portfolio management perspective, we believe this is an environment that rewards operational visibility, margin scalability, and management teams willing to cannibalize legacy processes. We also think a sober view of AI’s role in alpha generation is warranted.

At O’Keefe Stevens, we are using this moment to improve how we serve clients. Our goal is to add more families while maintaining our high service standard. We see firsthand how partnering with a financial advisor improves lives, and our mission is to scale that impact without compromising quality.

On the investment side, we’re trialing an overwhelming number of vendors. Nearly every week, we’re evaluating new tools, many of which appear to be wrappers on foundational AI models. These products often carry high burn rates and venture funding, and we are skeptical that most will still be operating five years from now. It’s not yet clear how equity positions in this space will fare, especially if the funding environment tightens.

Internally, we continue to debate which tasks should be automated and which require human oversight. Historically, many investors (myself included) built models by hand to absorb the trends. The act of typing in data isn’t valuable on its own, but it helps surface relationships. We’re trying both approaches: automation for speed, manual work for depth. Our vision is that in two years, a well-built model will identify anomalies, explain what’s driving them, and generate a first-pass report. That enables the analyst to identify the key debates more quickly, allowing them to focus on the alpha-generating research needed.

AI on its own will not generate alpha. In fact, we believe it may act as a net alpha dilutive force over time. The core premise of alpha is differentiated insight, which typically arises from structural advantages, behavioral edges, or access to nonconsensus information. As AI democratizes access to public data, historical context, and cross-sectional analysis, many of the advantages formerly derived from information synthesis are becoming commoditized.

This doesn’t mean AI lacks value. Quite the opposite. It is rapidly becoming table stakes, a tool that can increase processing velocity, enable broader coverage, and compress analytical cycles. But this compression applies to everyone. As research cycles tighten across the industry, any edge gained from faster summarization or wider surface area exposure will decay quickly. The tools will get better, the prompts will converge, and what once took hours will be done in seconds by everyone.

The more concerning dynamic is the illusion of competence. There is a risk that access to more contextually rich output leads to overconfidence in areas where the user lacks actual domain expertise. Nowhere is this more dangerous than in highly regulated, technically complex industries like healthcare or energy, where surface understanding is insufficient for investment decision-making. We expect many market participants to expand into unfamiliar sectors with misplaced confidence, armed with tools that enhance comprehension but not judgment.

For us, this is a cautionary tale. Our historical avoidance of specific sectors, not out of disinterest, but from respect for the limits of our expertise, remains intact. AI does not change our threshold for conviction. What it does allow is deeper iteration in areas where we already have a structural understanding. In housing, aviation, and consumer discretionary verticals like golf, we can now extend our insight upstream and downstream, uncovering adjacent opportunities, channel checks, and pricing dynamics with greater efficiency. Our goal is to always find management teams who understand where the puck is going. Today, this idea is ever more critical.

Portfolio Performance

2025 winners

Fannie Mae (FNMA)

Fannie Mae was our strongest performer during the year. The position benefited from shifting market expectations and the repricing of a complex and widely debated situation (privatization vs. conservatorship), with the stock reflecting the probability of Fannie and Freddie exiting conservatorship. This investment reinforced the value of patience and disciplined sizing when outcomes are asymmetric. We made our first purchase in 2013, 12 years ago. Indeed, our expectation was that the two entities would already have exited conservatorship, given that the rationale to enter conservatorship was highly questionable at best. Even with such horrible timing, from 6/1/2013 to our sale date of 10/15/25, FNMA returned 493.6%, almost all of which came in the last two years. Compared to the S&P 500, which gained ~321% during the same period. Incredible what patience can do.

During the fourth quarter, we sold our position in FNMA. While the position was a major contributor, we believed the risk/reward changed. While the probability of exiting conservatorship has increased under the current administration, the wide range of IPO valuations, timing, and still question marks about whether it’s possible, materially change the return profile. We are unsure how common shareholders will ultimately be treated in an IPO. Lastly, it is unclear how mortgage rates will be affected under privatization. With this administration’s intent on IPOing FNMA/FMCC, to drive a high enough ROE to satisfy public shareholders, while also ensuring guarantee fees do not increase the cost of a mortgage, is a balance that has not been figured out (yet). We suspect leverage ratios will be higher than what the original estimates were, thus driving higher ROEs. We will take the bird in the hand instead of waiting to find out what is in the bush.

We are pleased to have exited this position at an attractive return after a prolonged holding period. For clients who have been along for the entire ride, we apologize if this stock aged you in dog years. We are grateful to have clients that are aligned with our thinking and time horizon, allowing us to place asymmetric bets. We continue to hold a position in the preferred securities. Due to the contractual nature of these shares, we view them as less risky and a sole bet on an IPO/privatization. We need not have a view on the IPO structure as we will be taken out at par.

Sphere (SPHR)

Sphere experienced a volatile year in the market, but the underlying business made significant progress. During 2025, the company announced Sphere Abu Dhabi and refreshed its core content slate by launching its second in-house film experience, The Wizard of Oz, replacing Postcards from Earth.

Early results have been phenomenal. As of November 4, The Wizard of Oz had sold over 1.2 million tickets, and based on the pace of sales thereafter, we estimate it exited the year closer to 1.6 to 1.7 million. Ticket demand remained resilient even through seasonally slower periods in Las Vegas. Residencies were also encouraging. Several artists extended their runs or returned after completion. This signals both consumer demand and artist enthusiasm, suggesting Sphere’s format is moving from novel to repeatable.

Sphere’s economics are also evolving. The company reportedly spent $80m-$100m to produce Wizard of Oz, supported in part by AI-driven tools and a partnership with Google. As content tools improve, we expect development costs to fall. If future productions can be made at a fraction of today’s price, monetized across multiple venues, margins should and will expand materially. While the stock has appreciated significantly, we believe the market has yet to price in the improving unit economics and future Spheres fully. One can imagine Jurassic Park (or some other movie not from ~85 years ago) costing much less than the $100m spent on WoZ. In a few years, I will not be surprised if the Sphere resembles a movie theatre able to show many different films during the day, due to the significant deflation of the cost to produce. $10m (or some materially lower figure than $100m), spread across several spheres, compared to $100m at one sphere. This improves the unit economics of future Spheres, making them more attractive for municipalities or other companies to build. It will not shock us if, in the next few years, Sphere signs a “Franchise Partnership” with a PE or large fund that will promise to open X number of Spheres over a given time period. With every build, they likely find ways to increase efficiency and reduce construction time and cost. While we trimmed the position in the quarter due to portfolio management reasons, we remain immensely bullish on Sphere’s future.

2025 losers

GreenFirst Forest Products (ICLTF)

Things take longer to play out than one can imagine. The lumber industry has been in a 3+ year downturn, post the 2-year boom from the COVID demand pull forward. Credit to the management team at GreenFirst, as they have done everything imaginable to weather this challenging period. This included a rights offering, backstopped by Bob Robotti, sale of noncore assets, spinoff of money-losing pulp & paper business, securing a standby letter of credit from Canada’s Account Performance Security Guarantee (ASPG) program, pension surplus monetization, and idling of higher cost mills (building inventory in advance). All this, while undergoing a capex program to lower production costs at Chapleau. All of which is overshadowed by a prolonged period of low lumber prices.

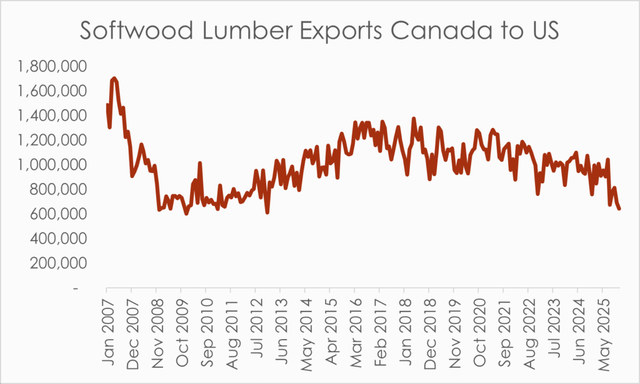

We believe we are at or nearing the beginning of a rebound in lumber prices. Shown in the chart below, softwood exports from Canada to the US are nearing levels not seen since the Great Financial Crisis. These exports also include billions in curtailed and idled facilities. When a producer idles capacity, they still have days or months of inventory on hand that must be sold (closer to liquidation). When borderline, indiscriminate sellers are ever-present in the market, pricing is capped. As this inventory is now worked through or nearing the end, export volumes over the next 6-12 months are likely to be lower than the preceding 12 months. Supply has significantly come offline, distributors are running lean inventories, and no one believes housing starts will ever increase. We find this setup attractive. Even if housing starts remain at lower levels, supply/demand is near balance today, with any uptick in demand resulting in a host of players scrambling for 2×4’s. If there is one thing the US administration wants, it’s for homes to become more affordable, likely through lower rates. While GreenFirst and Weyerhauser have both been poor performers over the last several years, we expect lumber prices to be inflecting finally, and EPS should begin to improve from here meaningfully. Due to the illiquidity of ICLTF/GFP, this was never a meaningful position, but one that has performed so poorly that it still negatively impacted results.

Q4 portfolio activity

During the fourth quarter, we made two meaningful changes.

We added to our position in Topgolf Callaway (MODG), which has since changed its name to Callaway after the sale of 60% stake in Topgolf. We added on the weakness when the company announced the sale, and the stock subsequently sold off, likely as investors were dissatisfied with the result of selling 60% instead of the entirety of Topgolf. We viewed the sale as a net positive, as the market ascribed no value to the business. A key tenet of our thesis was that the stock would transition from appearing highly levered to less so. This transaction did just that. We continue to view the stock as incredibly attractive, and believe fair value is $20+ compared to $11.70, where it ended the year.

As discussed above, we sold our position in FNMA, following a strong run (of late). Our combined position across FNMA and the preferred shares resulted in Fannie Mae securities comprising our second-largest position. Given the wide range of outcomes, we did not view this as a prudent portfolio position size. Selling the riskier common shares allows us to right-size the position, while still maintaining a call on the eventual privatization of the business.

In our top 5 positions, you will notice that Cash is our largest position. While we refrain from making macroeconomic or market-timing calls, after three years of strong performance, we are selling positions that have reached our estimate of fair value. We do not want to chase stretched valuations, path-dependent bets requiring conviction in a specific outcome, or sectors facing potential structural headwinds. We will wait for the right opportunity to deploy capital and will likely add to existing positions throughout the year.

We remain focused on disciplined fundamental research, responsible position sizing, and continuous improvement in how we operate. We appreciate the trust you place in us and look forward to navigating the opportunities ahead together.

Podcast

During the quarter, Dominick went on the Stock Spin-Off Investing Podcast, hosted by Rich Howe, to discuss the Topgolf Callaway thesis. Link Here.

Regards,

Dominick D’Angelo, CFA [email protected] 585-497-9878

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here

Leave a Reply